Last year seemed to be a year marked with great uncertainty yet extraordinary returns for investors. Indecision over unsustainable entitlement spending and deficits in the U.S., European debt crisis, China slowdown, U.S. corporate profit growth stalling, and Middle East turmoil all contributed to this uncertainty. We consider ourselves very long-term optimistic, but short-term cautious. We wish we could say the passage of time has resolved the impending sovereign over-indebtedness issue, but, unfortunately, quick fixes continue to delay, and likely compound, the inevitable. Hoisington Investment Management, our Austin neighbor who manages fixed income, stated our central concern clearly and succinctly in their recent Q4 2012 quarterly review, “We cannot tax ourselves into prosperity…we can, however, deficit spend ourselves into poverty.”

This past year housing appears to have stabilized, but remember there were moments when it appeared that way during the prior three years as well. Experts in the field remain mixed with their assessments, with some saying housing may have bottomed, while others point out prices are being propped up by government intervention and actually still need to drop 20% or more to revert back to long-term trends.

As usual, we do not claim clairvoyance over what the future holds. With so many moving variables, we find forecasts to be as valuable as the apocalypse prediction that was anticipated by the end of the Mayan calendar. However, what we do find valuable is digesting as much pertinent information as possible and then preparing for the possible outcomes. This is quite an unusual time when we are seeing bonds of some U.S. companies (XOM, JNJ) trading at yields below the U.S. Treasury’s with comparable maturities. In other words, some high quality U.S. multinational businesses are now being perceived as safer investments than Treasuries. We’ve long argued this to be the case and continue to concentrate our client portfolios in a select few high-quality stocks that we believe will generate attractive long-term returns with relatively low risk.

Even still, the YCG separate account strategies significantly lagged the S&P 500 in 2012 with our flagship strategy, Concentrated Composite with Option Enhancement, appreciating 3.93% versus the S&P 500’s 16.00% return. We’d be remiss if we didn’t mention that our 2011 performance was significantly better than the S&P 500, and so, on a 2 year basis, our modest underperformance isn’t significantly different than what we’d expect in a consistently rising, fully-valued market.

Mostly importantly, we are happy to report we’ve been able to accomplish our goal of outperforming the market over a full economic cycle with less volatility and risk over the first 5+ years of our existence with 9.72% annualized returns for our Concentrated with Option Enhancement separate account strategy since inception vs. 4.76% annualized returns for the S&P 500 over the same time period.

Reflecting on 2012, Reviewing Foundational Principles

While we view the January through December calendar year as relatively arbitrary and too short a time period to judge the long term performance of an investment strategy, we thought it would be helpful to current and prospective clients to explain the major reasons for our 2012 underperformance and to reemphasize the key tenets of our investment philosophy.

Our total return lagged the market for four primary reasons:

- We own mostly high quality stocks which, in our view, are defined as those with high returns on tangible assets (ROTAs), low cyclicality, short repurchase cycles, long product cycles, inelastic customer demand, wide and stable profit margins, high market share in core products, and conservative use of leverage.

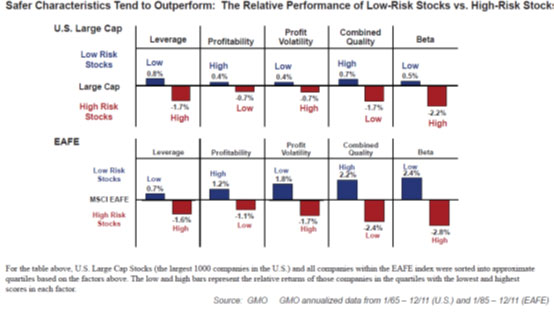

As you know from our prior client letters and website blog posts, our primary objective is to maximize long-term capital appreciation consistent with reasonable investment risk. In our view, the best way to accomplish this goal is to focus mainly on high quality securities as they have historically outperformed the market with less volatility (see chart below).

We expect this outperformance to continue because humans are, on average, overconfident, optimistic, impatient, and avaricious. These characteristics predispose investors away from high-quality, steady stocks and towards riskier stocks with a wider distribution of probabilistic outcomes and further cause them to overweight the likelihood of the outcomes in which they make money. This behavioral bias is innate, and we believe it is highly likely to continue to cause long-term, systematic underpricing of boring, high quality stocks like PG, PEP, KO, and CL. However, one implication of the our focus on high quality stocks is that, in strongly rising markets, we tend to lag because investors’ animal spirits push them even more than usual towards speculative stocks. Last year was no exception as the stock market was up 16.0% and many stable, boring, but fabulously profitable businesses that we owned (such as PG , PEP, and SYY which were up 5.1%, 6.3%, and 11.6%) and that we didn’t (such as KO, UN, and CLX which were up 6.5%, 14.6%, and 13.7%) lagged. However, just to reemphasize, over the long term, we strongly believe that these businesses, at current valuations, will generate better returns than the market with less risk.

- We sell covered calls and puts, both of which enhance returns over time but can cause us to lag in strongly positive markets.

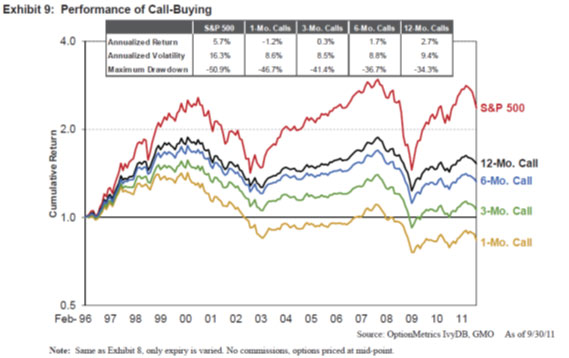

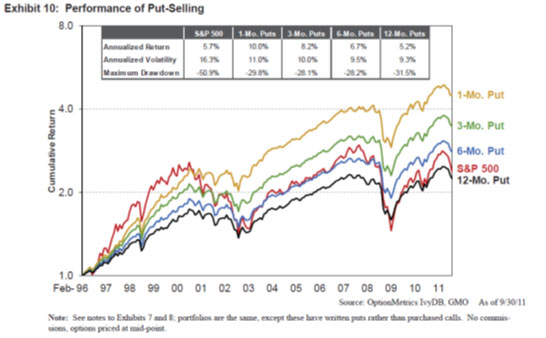

Another implication of our view that investors generally a) overprice securities that have ostensibly attractive asymmetric payoffs and b) underprice securities that have ostensibly unattractive asymmetric payoffs is that call buying (in which the downside of 100% is reasonably probable but the potential payoff is theoretically infinite, similar to the return characteristics of low quality stocks) should be overpriced and put selling (in which the downside is theoretically but improbably 100% but the upside is limited to the put premium, similar to the return characteristics of high quality stocks with generally low but high probability near term upside and theoretically but improbably 100% downside) should be underpriced. Empirical data supports this assertion, as can be seen in the charts below.

Here again, however, a strongly rising market can cause stocks to rise so fast that the appreciation in the stocks far outweighs the amount collected from selling the puts. In these cases, we may decide that the return from selling a new put at the higher price isn’t worth the risk, and, if we can’t find another undervalued stock to buy or on which to sell a put, then we may let our unencumbered cash holdings increase. Even if we do decide to sell another put on a rapidly rising stock, our return will be less than holding the stock outright if the stock continues to rise by more than the option premiums we’ve collected. Given that the majority of our portfolio is in plain vanilla equities and that our notional options exposure is normally only approximately 10% to 25% of the portfolio, we will almost always participate in stock market rallies, but we will likely lag in particularly frothy ones. However, in down markets and over a full market cycle, we believe our options strategy and the high quality nature of our stocks will enable us to outperform. Moreover, based on our historical separate account performance and the empirical data in the charts above, we believe that our strategy of selling puts and calls will enhance our returns relative to an identical portfolio of stocks in which we don’t use options.

- Except for in very distressed or cheap markets, we generally maintain a cash buffer of 5% to 15% (even after assuming all of the puts we’ve sold get assigned to us).

We view this excess cash as an option of sorts. We understand that today’s stock prices are not our only opportunity set and that the likelihood of tomorrow’s opportunity set being better than today’s increases along with stock market valuations. Thus, we will likely increase cash during periods in which a rising stock market causes forward rates of return to decline and we will likely decrease cash during periods in which a falling or stagnant stock market causes forward rates of return to increase. Our cash buffer (after puts) during much of last year was roughly 10%-15%, which is about what you should expect during a market like today’s in which we can find a reasonable number of securities that promise reasonable returns, but few securities that promise extraordinary returns like those available in periods such as 2008-2009.

- A small portion of our portfolio is invested in stocks with high expected returns but wide probability distributions of potential outcomes. While we believe these types of securities have been additive to the portfolio over time, the basket of these situations that we owned last year had an unusually high percentage of poor outcomes.

While we believe the majority of the bargains most of the time will be in high quality stocks as a result of investors’ proclivity for high-risk, high-reward situations, investors are also loss averse and increasingly so the more they’ve already lost, so there are times in industries (2000 telecom & internet bust) or in the broader market (1929, 1973-74, 2008-09) when prices drop so much that investors’ loss aversion overrides their optimism, overconfidence, and avarice, leading them to overestimate risk, particularly in the case of lower quality stocks. This effect, combined with forced selling from the overleveraging that generally occurs when prices are going up, further fuels the undervaluation of lower quality stocks (Side note: Leveraging up during good times isn’t as common in higher quality stocks since their high return on invested capital means they don’t need leverage to generate good returns for shareholders).

As a result, we are always on the lookout for those areas of the market in which investors have experienced such a rapid and painful loss that they are actually underpricing stocks with a large range of potential future outcomes. While these types of stocks will never be central to what we do, we believe they can be additive to portfolio returns over time. In past years, we’ve had great success with these types of situations. American Express, Americredit, and Resource America, all of which we bought during the financial crisis of 2008-09, are examples of “wide bell curve” stocks in which we quickly doubled, tripled, and even quadrupled our investment. Last year, however, our basket of “wide bell curve” stocks significantly underperformed the market as we had a high percentage of them experience negative outcomes. Examples of stocks in this basket that we owned last year include RIMM, HPQ, CECO, APOL, and WU. While the underperformance of this basket was unfortunate, the laws of probability mean that it was also highly likely to occur at some point. Thus, we don’t view one bad year as an invalidation of allocating a small amount of a capital to a select basket of high risk-high reward ideas, especially since we believe it’s been additive to the portfolio even including last year’s disappointing results. That being said, our experience over the last year with “wide bell curve” stocks has caused us to require even more asymmetric upside vs. downside in order to get involved in these types of securities and to be particularly cautious when investing even a small amount of capital in secularly declining businesses. These businesses can appear very attractive based on measures of statistical cheapness, but we’ve gained an even greater appreciation of their danger as potential value-traps in which their core business deteriorates faster than expected and/or management recklessly spends cash flow in wild pursuit of reclaiming the growth and glory (and higher compensation) of years past. As a result, we’ve reanalyzed all of the securities in the basket, and, based on our evaluation of their risk-rewards (inclusive of any new evidence since the positions were initiated), we’ve sold some, reduced the position sizes of others, and increased the position sizes where appropriate.

So, the bottom line is that we underperformed last year because of a number of factors systemic to our portfolio, which we believe we’ve constructed to protect against large drawdowns while enabling us to provide better returns than the market over a full market cycle, and one factor that was a combination of bad luck and also of a couple of bad stock picks. These factors systemic to our portfolio are our preference for high quality stocks, our conservative selling of put and call options to enhance returns and generate extra income, and our maintenance of a cash buffer. The factor that was a combination of bad luck and a couple of bad stock picks was the significant underperformance of our basket of “wide bell curve stocks,” the size of which we’ve decreased and the quality of which we’ve upgraded significantly.

We hope this in-depth discussion helps give you further insight into how we think and what to expect from our firm. Now, we would like to take a moment to explain a major purchase we made in your portfolios last quarter.

MSCI: Emerging Market Opportunity?

Early in the quarter, shares of MSCI dropped 30 percent on news that Vanguard, one of its largest clients, would be switching benchmark providers to FTSE to cut costs. By our estimation, this $24 million loss in revenue and operating income translates into a 10% haircut to MSCI’s trailing earnings. However, the reason the stock is down much more is due to the fear that this change will force MSCI to cut its prices in order to retain the remaining customers in its asset-based fee business. We believe these concerns are overblown.

MSCI is an extremely profitable, scalable, recurring revenue business with very few capital needs. Its flagship product, which makes up about 32% of revenue, is a subscription-based indices business. A very strong brand name, MSCI has long been viewed as the gold standard for international indices. In part, this is because MSCI smartly chose to essentially give away its services to pensions and endowments, which in turn mandate their managers to use MSCI, creating a network effect that has led to nearly 90% market share. This strength has led to an attractive asset-based fee business (14% of revenue before the Vanguard defection) in which MSCI usually collects 3 basis points or more for firms such as Blackrock to simply have the MSCI label on their index funds and ETFs – more on this in a moment. MSCI’s other crown jewel (39% of revenue) is its risk management and portfolio analytics software business (RiskMetrics and Barra) where customers experience high switching costs the more ingrained they become in the software. Finally, MSCI has an attractive corporate governance business (ISS) that contributes 13% of revenues. Nearly half of its total revenue stream comes from overseas and, until the recent Vanguard news, appeared very sticky with all of its lines of businesses at approximately 90% retention rates.

Before investors decide to write-off the value of these businesses, we believe it’s important to recognize that MSCI benchmarks are written into contracts across many pensions and endowments, making it difficult for these institutions and their money managers to switch to a different benchmark. Additionally, institutions generally care more about trading liquidity and tracking error than expenses, meaning that the sheer volume of assets managed in MSCI-branded index funds and ETFs adds to their desirability versus competing products. These deep customer relationships and valuable product advantages are likely why CEO Henry Fernandez stated in the conference call discussing the Vanguard developments that MSCI management is confident in the strength of their brand and refused to negotiate lower on pricing. So, while there will probably be some pricing pressure on MSCI, we think the odds are good that this pressure will be less than expected given Vanguard’s more retail focus and MSCI’s entrenchment in the institutional world. Fortunately, Blackrock, MSCI’s biggest customer, has already indicated it’s sticking with MSCI for its iShares ETFs. Additionally, our sensitivity analysis indicates that even if we’re wrong about the extent of the fee pressure that MSCI will experience, the forward expected returns from the current stock price would still look fairly attractive – particularly when one considers the tailwinds towards index funds and ETFs in general, as well as fund flows into international assets as we become a more global world.

We believe the market has overreacted on the news and created an opportunity to become an owner of a fabulous business at a good price.

Concluding Remarks

As always, we are invested right alongside you. We encourage you to remain focused on a long investment horizon. Although many of our more boring, stable businesses tend to miss out on short-lived rallies, we are confident that sticking with our strategy will continue to produce favorable investment results over the long-term. And while many global challenges still remain, there is much to be optimistic about when one takes a long view. We have upgraded the portfolio from a high quality portfolio to what we believe to be an incredibly high quality portfolio prepared to withstand the storms that may lie ahead. Should the storms not surface for quite some time, we believe the companies you own will continue to preserve and compound your capital at a healthy clip. We will continue to be patient and objective as we diligently seek out the best risk-adjusted expected returns.

We thank you for your continued trust and loyalty. Wishing you a happy, healthy, and prosperous 2013!

Sincerely,

The YCG Team

Disclaimer: The specific securities identified and discussed should not be considered a recommendation to purchase or sell any particular security. Rather, this commentary is presented solely for the purpose of illustrating YCG’s investment approach. These commentaries contain our views and opinions at the time such commentaries were written and are subject to change thereafter. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. These commentaries may include “forward looking statements” which may or may not be accurate in the long-term. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. Past performance is no guarantee of future results.