After a blistering fourth quarter rally in which the S&P 500 index rose 10.5%, the index finished strong for the year, up 32.4%1. We are quite happy with your portfolio’s results over this time period as they are largely representative of what we would anticipate during bullish time periods such as the one we are currently experiencing, with this year providing the exclamation point to an amazing five year resurgence of U.S. stock prices.

In our view, as the market continues to advance, rising portfolio values lull many investors into complacency. The trouble is that stock returns, especially in speculative and cyclical issues, have been racing ahead while sustainable business earnings, in aggregate, have barely budged. In other words, returns this past year can largely be explained by price-to-earnings (P/E) multiple expansion, which is particularly concerning when profit margins are also near record highs. We believe that over the long term, regardless of what many short-term stock charts imply, business values cannot grow faster than their underlying cash flows. Thus, our priority is to identify businesses that we believe can swim against a possible tide of declining margins and/or stagnant or declining price-to-earnings ratios, while still swimming well with the tide if these risks never come to fruition.

We believe we have constructed your portfolio to be full of these types of companies and are pleased that it has delivered solid results despite what we believe to be its high quality, defensive nature. While we realize that owning a portfolio with a large overweighting of consumer defensive companies such as Procter & Gamble, Coca-Cola, and PepsiCo increases the probability that our portfolio will lag during strong bull markets (as it did during this past year), we believe it reduces risk and enhances return by increasing the possibility that our portfolio will outperform during sideways or downward markets, enabling us to go on the offensive during periods of investor apathy or distressed selling. Today’s market is decidedly not one of those periods, so we’re content to hold these stocks, since we believe they are still priced to deliver attractive returns over the long term.

Some question why we remain bullish on these types of holdings when their P/E ratios appear high. First, we believe this is because investors tend to underestimate the value of consistent cash flow. Consider a business we will call “Steady Eddie” that earns $1/year and can be purchased for $20, or 20 times earnings. Suppose this business does not grow, but it consistently earns $1/year for 4 years and consistently trades at a P/E multiple of 20. Now, compare this to another business we will call “Cyclical Cyclone” that also trades at $20/share. In the first year, it also makes $1/share, so it appears to also have a P/E ratio of 20. However, suppose it earns $2 in year two, then loses -$2 in year three, and earns $1 again in year 4. Over the ensuing 4 years it averaged $0.50/year, implying that, in year one, you did not really pay 20 times earnings for “Cyclical Cyclone,” but rather 40 times earnings! Oftentimes investors pay irrationally high multiples during periods of peak earnings as they extrapolate future expectations from the peak, and pay irrationally low multiples during trough earnings.

Second, we believe investors tend to underestimate the value of a company having the ability to convert a high percentage of their earnings to cash for shareholders. Just because a business earns money does not mean you get to see it as a shareholder! Some businesses are “hungrier” than others and may reabsorb more than 50% of their supposed free cash flow in order to protect and grow their business. For example, suppose you can purchase “Cash Gusher” for 20 times earnings or “Money Muncher” for 10 times earnings, and both businesses are growing at the same rate. Why would anyone in their right mind pay twice as much for Cash Gusher? Well, suppose Cash Gusher can pay out 100% of its earnings to you while Money Muncher is so capital intensive it can only pay out 25% of its earnings in order to maintain its business and make acquisitions to protect its franchise. This implies you did not pay 10 times earnings like you thought, but rather 40 times earnings! Thus, when you purchased Money Muncher for what you thought was 50% off, it turned out it was actually twice as expensive as Cash Gusher.

These two principles demonstrate that not all P/E multiples are created equally. In our view, this explains why a business such as Procter & Gamble (P&G) traded at an average trailing P/E ratio above 20 for the last couple decades and still produced compound returns at over 11% annually. Many investors believe that a high growth rate is required to achieve a healthy return if a stock is purchased at a high multiple, but P&G and other “Cash Gushers” have consistently and resoundingly disproved this assumption. During the period in question, P&G only grew around 5% annualized. Instead, the combination of the two principles discussed above – consistent earnings and P&G’s ability to convert nearly all of its earnings to cash for shareholders in the form of dividends and share repurchases – led to outsized returns despite the relatively higher price tag.

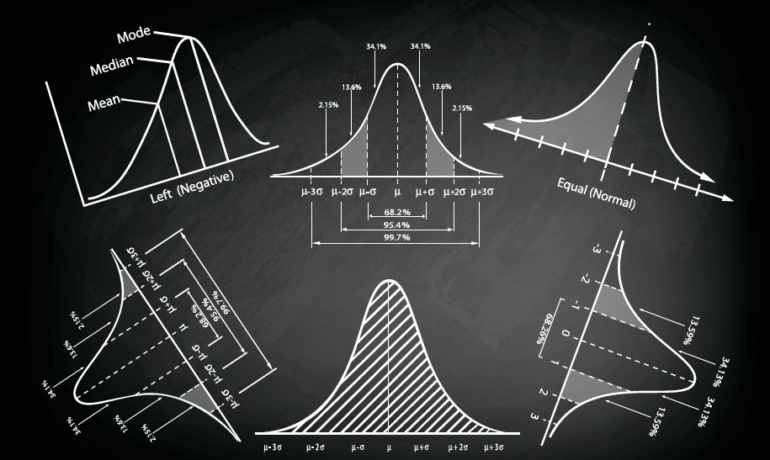

We tend to view the world in terms of probability distributions. Our analysis suggests that, in the current environment, these “narrow bell-curve” (higher quality) stocks oftentimes have higher expected returns than “wide bell-curve” (lower quality) stocks. In other words, the expected returns in these businesses are especially attractive when one considers the consistency of these businesses and their ability to return cash to shareholders. We want to be clear to communicate, however, that this defensive portfolio will likely not always be the case. We are willing to invest a portion of our portfolio in cyclical high quality businesses, and even in lower quality stocks, but only if we are convinced that we are being compensated to take on the additional risk.

We’re invested right alongside you, thus strongly aligning our interests with yours. Additionally, we realize that many of you have entrusted to us a high percentage of your savings. We do not take this responsibility lightly. As such, we will continue to relentlessly pursue the best risk-adjusted returns.

We thank you for your trust and loyalty and wish you a happy, healthy, and prosperous 2014!

Sincerely,

The YCG Team

Disclaimer: The specific securities identified and discussed should not be considered a recommendation to purchase or sell any particular security. Rather, this commentary is presented solely for the purpose of illustrating YCG’s investment approach. These commentaries contain our views and opinions at the time such commentaries were written and are subject to change thereafter. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. These commentaries may include “forward looking statements” which may or may not be accurate in the long-term. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. Past performance is no guarantee of future results.