The S&P 500 Index returned 7.56% and the S&P Global Broad Market Index returned 9.92% in the quarter ended December 31, 2022.1

As the last few years have demonstrated, the future is radically unpredictable. However, because we humans are prone to overconfidence, many continue to believe they can make specific and timely predictions about all manner of things, including interest rates, the economy, foreign currencies, geopolitics, and, of course, the stock market. As we’ve reiterated many times in past letters, we know we can’t predict these things. Yet even if we recognize this fact, we are faced with an uncomfortable truth: Every possible investment strategy or allocation embeds within it a host of predictions and thus will work well in some possible futures and not as well in others. For example, an all-bitcoin investment allocation would work great in a future where global distrust in governments rises over time and investors increasingly choose cryptocurrency as a store of value and bitcoin continues to be their preferred cryptocurrency and the financial and legal infrastructure of cryptocurrency matures to a level that fraud, theft, and other counterparty risk decrease to very low levels. However, in the many possible futures in which one or more of these conditions doesn’t occur, an all-bitcoin investment allocation could be disastrous.

Now that we have defined the problem—the future is unpredictable, but we are forced to make predictions anyway—what is the solution? Unfortunately, there is no one optimal “solution,” but the solution that makes sense to us is to construct a portfolio with predictions that are both 1) as general in scope as possible and 2) time-tested. We attempt to achieve this goal at both the portfolio level and at the individual company level.

Portfolio-Level Predictions

At the portfolio level, one prediction embedded in our investment allocation is that human innovation will, over the long term, grow the world’s aggregate wealth. This prediction is both broad-based and time-tested, as evidenced by the long-term decline in the cost of necessities (as a percentage of GDP) and the increasing abundance of goods and services available to us all. We express this prediction by owning a diverse collection of businesses that are over-indexed to industries that have historically maintained or grown their share of GDP as wealth grows, such as capital markets, insurance, luxury goods, and advertising, and under-indexed to industries whose share of GDP has historically shrunk, such as energy and materials. Our next portfolio-level embedded prediction is that businesses that own dominant, mission-critical networks will continue to be a great way to reliably capture a proportionate share of an industry’s value growth. We can break this down into two sub-predictions. The first predictions is that, since the nature of networks is that their value scales exponentially with size, businesses that own dominant networks will be not only difficult to disrupt but also allow their management teams to sustainably increase prices and profitability over time as the networks grow, especially if they benefit from multiple, overlapping network effects (protocol, physical, belief, marketplace, etc.) and/or other barriers to competition such as high switching costs, regulatory privilege, or not-in-my-backyard zoning restrictions (such as Copart’s junkyards). We believe this prediction is also broad-based and time-tested as evidenced by the fact that most of these businesses have maintained or grown their industry-leading positions, prices, and profitability for, in most cases, many decades. The second sub-prediction is that these stocks tend to be attractively priced. We believe this prediction is also broad-based and time-tested as evidenced by the wealth of studies on the historical underperformance of speculative, wider-variance stocks and outperformance of more mature, higher-quality, and lower-variance stocks. We believe this underpricing of high-quality stocks will continue because we believe it stems from the all-too-human desire to get rich quick combined with the average investors’ overconfidence in his or her ability to do so.

However, notice what predictions we are not making. By owning a diverse collection of dominant businesses that possess conservative balance sheets, innovative and adaptable owner-oriented management teams, and, in many cases, significant untapped pricing power, we are not going “all-in” on a specific industry, company, or product nor are we making a prediction that the short- to medium-term will be smooth sailing. Rather, we believe our portfolio’s diversification and the resilience and adaptability of the underlying businesses will enable our portfolio to grow its long-term value in many different possible futures, even the many possible ones that involve prolonged competitive and economic hardship.

Individual Company Predictions

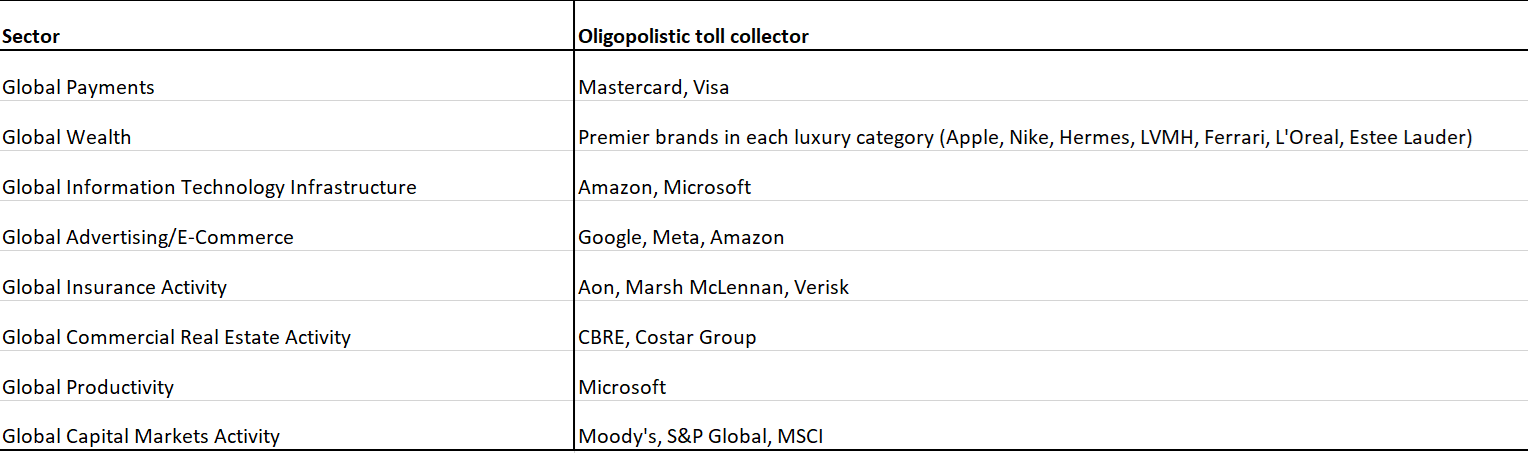

Our efforts to limit specific predictions continue at the individual company level. Instead of attempting to make a general prediction about both an industry sector and specific predictions about individual product-lines or sub-categories within the industries in which we invest, we try and stop at the general prediction, opting for what we believe to be the safer and more robust approach of attempting to collect a small toll on as broad a category as possible. For example, in capital markets, we could try and make a prediction on a specific Turkish shipping company’s bonds. However, this bet requires us to make a prediction not only on the fundamentals of the global capital markets but also on the fundamentals of the debt capital markets, Turkey, the shipping industry, and a specific shipping company. Unfortunately, there are many possible futures in which one of these predictions turns out to be disastrously incorrect. However, by owning Moody’s, S&P Global, and MSCI, we believe we are making a much broader prediction that global capital market activity will continue and even grow over time and that these oligopolies will continue to essentially collect tolls on this activity, as they have for many decades. Similarly, in commercial real estate, instead of betting on industrial or multifamily or retail commercial real estate, we think it’s more resilient and robust to own CBRE, which has historically collected what amounts to a toll on global commercial real estate activity. In fact, we believe nearly all our large positions can be described in this way, as we demonstrate in the chart below:

Interestingly, we believe the fact that relatively few predictions are required to invest in these businesses also helps explain why their management teams often generate consistent, industry-beating capital allocation records for many decades. The management teams in charge of these businesses can, in most circumstances, be confident deploying capital because of the industry-wide reach of their services. While we believe they can’t know what specific country, sub-industry, or product will produce what return, we believe they can feel confident that, averaged-out, they are likely to get a good return and, therefore, can methodically invest in good times and bad. Jeff Bezos, who has achieved the unique distinction of creating massive and profitable toll collectors (Amazon Retail and Amazon Web Services) in two disparate but enormous industries, sums up this advantage as follows:

I very frequently get the question: “What’s going to change in the next 10 years?” And that is a very interesting question; it’s a very common one. I almost never get the question: “What’s not going to change in the next 10 years?” And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time. … [I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, “Jeff, I love Amazon; I just wish the prices were a little higher.” “I love Amazon; I just wish you’d deliver a little more slowly.” Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.

Concluding Thoughts

If the last few years have taught us anything, it’s just how surprising the future can be. As investors, we need a strategy to deal with this unpredictability, and, at YCG, we’ve tackled this problem by attempting to limit our predictions to just a few that we believe are both broad and time-tested: 1) human innovation will continue to make the world wealthier over time, driving down the cost of necessities and increasing abundance; 2) businesses that own dominant networks in growing industries will be not only difficult to disrupt but also allow their management teams to sustainably increase prices and profitability over time; 3) these businesses will tend to be attractively priced because of the human tendency to overpay for “lottery tickets” (speculative stocks) and undervalue slow and steady gains; and 4) owning toll-takers on whole industries will generally be both safer and more profitable than trying to pick the biggest winners in the sub-industries.

Using this framework, we’ve built out a collection of dominant businesses diversified by industry, geography, and macroeconomic sensitivity. Furthermore, we’ve built in additional margin for error by prioritizing companies with untapped pricing power, conservative capital structures, and ample cost-cutting opportunities. As a result, while we may experience continued rough times in the economy and the stock market over the next few years, we believe your portfolio is resilient, adaptable, and likely to maintain or grow its purchasing power over the long term.

As always, thank you so much for your trust, know that we continue to be invested right alongside you, and please always reach out to us if you have any questions or concerns. We’re here to help!

Sincerely,

The YCG Team

Disclaimer: The specific securities identified and discussed should not be considered a recommendation to purchase or sell any particular security nor were they selected based on profitability. Rather, this commentary is presented solely for the purpose of illustrating YCG’s investment approach. These commentaries contain our views and opinions at the time such commentaries were written and are subject to change thereafter. The securities discussed do not necessarily reflect current recommendations nor do they represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. A complete list of all securities recommended for the immediately preceding year is available upon request. These commentaries may include “forward looking statements” which may or may not be accurate in the long-term. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. S&P stands for Standard & Poor’s. All S&P data is provided “as is.” In no event, shall S&P, its affiliates or any S&P data provider have any liability of any kind in connection with the S&P data. MSCI stands for Morgan Stanley Capital International. All MSCI data is provided “as is.” In no event, shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data. Past performance is no guarantee of future results.

[1] For information on the performance of our separate account composite strategies, please visit www.ycginvestments.com/performance. For information about your specific account performance, please contact us at (512) 505-2347 or email [email protected]. All returns are in USD unless otherwise stated.