The S&P 500 posted a 3.09% gain during an uneventful second quarter.[1] Despite this relative tranquility, we were able to acquire a new position in Alphabet (GOOG) at what we believe were attractive prices. Because the world changes so much over time, and at seemingly accelerating rates, successful investors must wholeheartedly embrace continuous learning. We believe our investment in Alphabet provides a good example of our own efforts to push the bounds of our knowledge. Back in 2012, we felt comfortable acquiring a small position in Google (now known as Alphabet) when the valuation was pressured by fears of increased competition from Facebook as well as by concerns around loose spending by Google management. When these issues proved overblown, the stock price increased and we exited the position. Since then, we have deepened our understanding of the characteristics that lead to enduring pricing power and growth. Additionally, we have gained increased confidence that Alphabet’s business possesses these key attributes. Taken together, these insights, detailed below, enabled us to confidently reinvest in Alphabet, and in greater size this time around.

Alphabet

We believe Alphabet, most notably the owner of Google and YouTube, is one of the best businesses in the world. Like our other favorite businesses, it operates in an industry with inherent pricing power, is a dominant player within its industry, is founder-led and -controlled, and has a long product penetration runway.

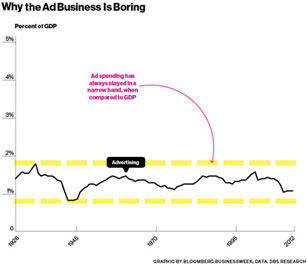

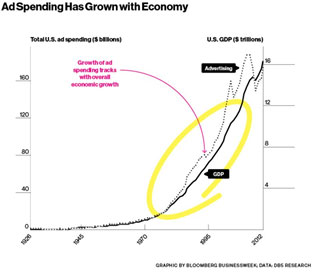

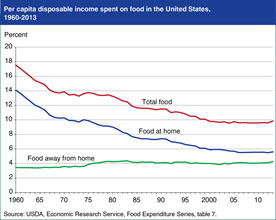

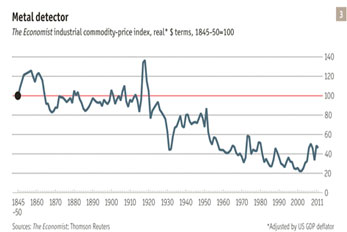

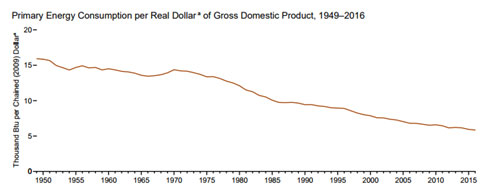

First, we believe Alphabet operates in an attractive industry. While Alphabet is described most often as a technology company, in many ways, it’s more accurate to describe it as an advertising company. After all, advertising is the method by which it earns the vast majority of its revenues. Therefore, when analyzing Alphabet’s future growth potential, we must first understand the prospects for global advertising revenues over time. The prospects are quite good for one simple reason: advertising is one of the ultimate relative goods, lending the industry significant pricing power over time. The more businesses spend to develop mindshare, the more other businesses must spend to keep up since what consumers purchase is largely dependent upon relative mindshare. Another way of looking at advertising is that it is, essentially, the meta pricing-power good. Through advertising, companies attempt to develop pricing power by convincing consumers that their products 1) possess small purchase prices relative to the value provided and/or 2) will make consumers more desirable to the groups and individuals with which they wish to belong and connect (i.e. confer social status). Thus, while spending on most goods becomes smaller as a percentage of the economy over time because of innovation, the advertising industry’s share of GDP has stayed remarkably constant, enabling it to fully participate in the economy’s remarkable gains in wealth.

Compare this stability of economic share to other big categories of spending:

As you can see, advertising has shown clear pricing power relative to other categories of spending, and, as we explained above, we believe the reasons for this pricing power are likely to be enduring.

Our second reason for believing Alphabet is a great business is that it has secured such a dominant position in the advertising/media industry that we believe competitors will have a very difficult time meaningfully encroaching upon this position in the future. We believe the causes of this dominance are two-fold: 1) In our opinion, Alphabet’s services are incredibly valuable to both the general public and Alphabet’s advertising customers, especially relative to the cost of these services; and 2) we believe the network economics behind this value lead to almost monopoly power.

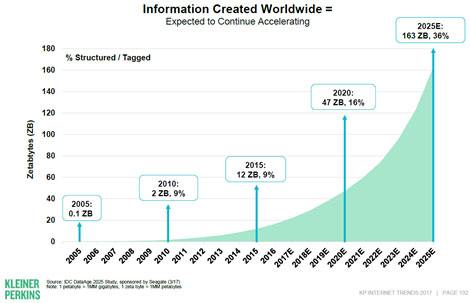

To understand these concepts better, let’s examine Alphabet’s two most valuable services, Google Search and YouTube. The product that both these companies sell is, essentially, value-added filtering. Because humanity’s collective innovation is driving wealth per capita and consumer choice up while, at the same time, driving the cost of virtually everything down, time is increasingly our most scarce resource. Nowhere is this trend more obvious than in the growth of the Internet, where, according to Kevin Kelly’s 2016 book “The Inevitable,” we annually gain access to 8 million new songs, 2 million new books, 16,000 new films, 30 billion new blog posts, 182 billion tweets, and 400,000 new products. Not only that, these numbers are growing at an accelerating rate over time, as can be seen in the chart below. Amazingly, an examination of the area under the curve shows that we have created more information every few years than the sum-total of all the information that had been created throughout the whole span of human history prior to those years. Because of the economics of networks, growth of this magnitude is expected to continue well into the future.

This rapid growth in information makes each individual piece of information less valuable while making the problem of finding the most personally useful information exponentially more so. Thus, while many newspapers, magazines, and movie studios are finding it increasingly difficult to monetize video and word content, low-cost and effective filters such as Google Search and YouTube are generating large and growing revenues.

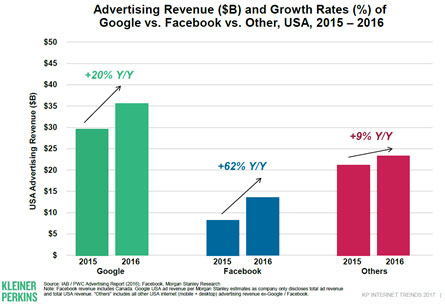

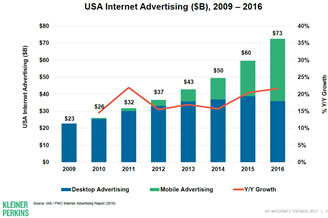

Importantly, because search optimization is so hard, content is growing so fast, tiny increments of relative speed lead to such large differences in customer satisfaction, free search is so habit forming, and filtering of information is so incredibly useful, these businesses tend to generate monopolies in their filtering niches. Google Search and YouTube are no exception. Including China, where Alphabet’s refusal to comply with censorship laws has relegated it to little more than a bit player with less than 5% market share, Google Search has 80% global market share. Excluding China, Google Search’s market share is in the high 80s. YouTube is arguably even more dominant than Google Search, possessing 97%+ market share relative to its main direct video aggregation competitor, Dailymotion.[2] Even relative to all of video media, YouTube is remarkably dominant with global consumers spending over 1 billion hours per day on the website versus only 116 million hours on Netflix and 100 million on Facebook.[3] Furthermore, YouTube’s prospects for defending this market dominance remain bright since it captures the long tail of the growth in videos through its open source, decentralized publishing model where anyone can post anything to its site so long as the video meets the community’s standards. If all Google Search and YouTube offered were their enormous global reach, they would be incredibly valuable to advertisers. When combined with their market-leading filtering technologies, however, they become completely indispensable, offering advertisers more value per dollar than most other advertising mediums and far more value than other direct filtering competitors. The compelling value of these platforms and the winner-take-all world they have created is evident in the chart below. Despite the desperate attempts of innumerable competitors both large and small, only two players, Alphabet and the similarly dominant social media Goliath, Facebook, captured virtually all the world’s advertising growth last year.

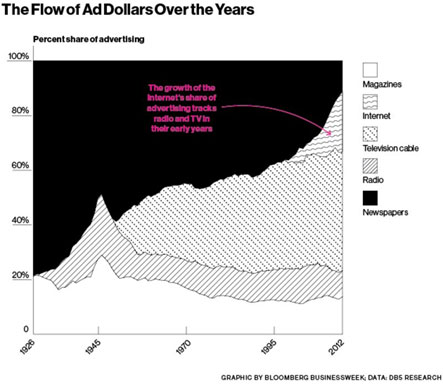

Based on the evidence we’ve thus far examined, Alphabet’s market-leading position seems impregnable. However, while we believe Alphabet’s moat is undoubtedly large (hence our ownership of the stock), the history of advertising teaches that Alphabet must stay vigilant to one threat: the rise of new media platforms. As the chart below demonstrates, these transitions occur periodically and inevitably.

If Alphabet is unable to establish as dominant a presence on the next big attention-grabbing platform, as happened to Microsoft in the transition from desktop to mobile, then its revenues could be at risk.

Fortunately, our third reason for believing that Alphabet is a great business — our confidence in its founders’ strategic vision and long-term viewpoint — gives us great comfort on this score. Alphabet’s founders, Larry Page and Sergey Brin, have already demonstrated their ability to successfully defend existing platforms and secure prominent roles on emerging ones. For evidence of the former claim, we must look no further than their experience protecting their lead in desktop search. By releasing strong ancillary applications such as Gmail, which currently holds 21% global market share,[4] and Google Chrome, which leads with 60% global desktop market share,[5] Alphabet plugged holes that competitors could have potentially used to gain a foothold in the search engine market. Moreover, unlike Microsoft, Google foresaw the threat of mobile and, through its brilliant investment in the mobile operating system Android, used this platform transition to not only defend its lead in search but to expand it. By open sourcing Android and making it freely available, Alphabet has achieved 88% global market share of mobile operating systems.[6] Because it possesses a virtual monopoly on the mobile platform, Alphabet has been able to populate Android with useful apps such as Google Maps (itself a monopoly with 93% global market share[7]), Google Photos, Google Assistant, Google Drive, YouTube (another brilliant acquisition), and, of course, Google Search. As a result, Google Search is even more successful on mobile than it is on desktop with 95% global market share on mobile devices versus only 80% global market share on all platforms combined.[8]

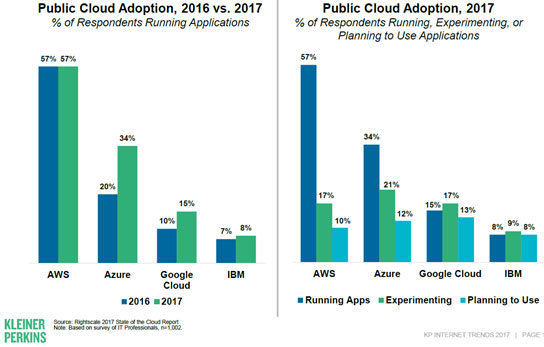

Not content to rest on their laurels, Larry and Sergey are also planting seeds in emerging consumer platforms such as the connected home with Google Home and Nest, the autonomous/connected vehicle with Waymo, the connected body with Verily, artificial intelligence with DeepMind, and virtual reality with Daydream. Alphabet is even making inroads into enterprise solutions, an area of historical relative weakness, having achieved a strong number 3 position in cloud computing behind Amazon Web Services and Microsoft Azure.

Further adding to our confidence in its future, the ownership structure of Alphabet, with Larry and Sergey controlling 51.1% of the voting shares, ensures that the founders’ long-term vision will not be corrupted or derailed by the sometimes short-term-minded activist investors that have become all too common in the public markets today.

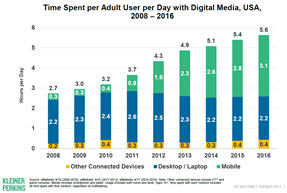

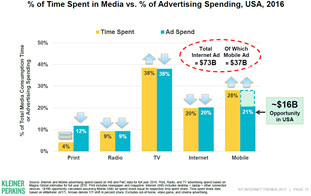

Our fourth reason for believing Alphabet is a great business is its low product penetration, which should enable continued growth even if the company fails to successfully navigate the transition to the next popular advertising medium. Consider the experience of the older tech giants, such as Microsoft, Oracle, and Cisco. Despite lagging behind key competitors on important platform transitions within their industries, most of them are still surprisingly robust. Certainly, part of the explanation for these giants’ continued strength is their network-effect-driven pricing power, which allows them to grow even as the volume of sales in their economic niches stagnates or declines. Another piece is their huge returns on capital, which allow them to buy growth (i.e. buy companies that allow them to consolidate share in shrinking industries or to gain a foothold in growing industries). However, a third major factor in their continued growth is undoubtedly their low global product penetration. Alphabet will likely benefit from this third factor for years to come. Today, fewer than 50% of the world’s population have access to the Internet,[9] and fewer than a third own a smartphone.[10] Moreover, even in the United States, where 88% of people have access to the Internet and 77% own smartphones,[11] Internet advertising dollars continue to grow rapidly, most recently reaccelerating to over 20% per year, because of the dual impact of increased time spent per adult on digital media and low advertising penetration relative to usage.

Finally, online commerce is still only 12% of total US commerce.[12] Growth in this category of spending could fuel further increases in daily Internet usage, which may lead to incremental search growth as well. In summation, we believe Google has ample runway to grow penetration in both mature and developing markets.

Now that we’ve hopefully demonstrated the quality and likely longevity of Alphabet’s business, we can turn to our analysis of the price at which the business is available for purchase. Interestingly, Alphabet trades at approximately the same next twelve months earnings multiple (25x) as many of the consumer-packaged goods (CPG) companies we own. This valuation parity is despite 1) Alphabet’s significantly faster revenue and profit growth of approximately 20% versus the CPG companies in the low- to mid-single digits; 2) a largely unmonetized YouTube that likely contributes negligible amounts to profits but could be worth somewhere between $75 billion and $300 billion;[13] 3) numerous venture bets such as their self-driving cars software, Waymo, and healthcare/life sciences company, Verily, that are currently generating $2.5 billion in losses per year[14] but that could eventually contribute billions in profits per year; 4) an $88 billion net cash hoard as opposed to the material but easily manageable net debt of the consumer staples we own; and 5) virtually infinite returns on tangible capital. While we acknowledge that Alphabet’s competitive advantages are perhaps not quite as strong as those of CPG companies given the relative frequency of advertising medium transitions compared to the remarkable endurance of people’s willingness to pay premiums for brands that serve as low-cost filters and/or enhance status, we believe Google offers comparable risk-adjusted returns to our CPG businesses given all the advantages listed above.

Another way to think about Alphabet versus our CPG investments is to strip out the non-core assets listed above so that we can estimate the value of “core” Alphabet (i.e. Google’s businesses). Currently, Alphabet trades for $948 a share or approximately 25x consensus estimates for Alphabet’s next-twelve-months GAAP[15] earnings. Starting with the easiest-to-estimate adjustments, if we subtract the company’s net cash of $125 per share from Alphabet’s stock price, we arrive at a valuation of approximately 22x next-twelve-months earnings. If we further add to our earnings estimate the $3.50 per share of losses attributable to Alphabet’s venture bets and assume a very conservative value of $0 for these bets, we arrive at a valuation of 20x next-twelve-months earnings. If we then subtract YouTube’s value of $107 per share, which is equivalent to the more conservative $75 billion estimate mentioned above, the multiple for the rest of Alphabet declines to 17.5x next-twelve-months earnings. For this price, investors receive Google Search, Android’s app store Google Play, Google Cloud, and Alphabet’s hardware offerings. We estimate that this package of assets is currently growing revenues at high-teens rates and that Google Search, the most mature of these remaining businesses, is growing at low-teens rates.[16] In our view, the valuation discount the market is applying to “core” Alphabet relative to our CPG investments offsets the potentially modest risk of a problematic advertising platform transition in the next 20 years.

In summary, we believe our investment in Alphabet has the potential not only to generate attractive risk-adjusted returns on its own but also to upgrade our whole portfolio’s risk-adjusted returns by further diversifying the portfolio’s cash flows.

Concluding Remarks

Investing is a journey of lifelong learning, requiring the practitioner to develop mental models about the way the world works and to continue to test these mental models against the constant flow of new evidence as the future becomes the present and then the past. In some cases, this new evidence leads to small modifications of these models. In others, it leads to the wholesale scrapping of existing models and the creation of brand new ones. Fortunately, because our strategy doesn’t force us to make a buy or sell decision on every single one of the tens of thousands of stocks available, we can focus our time and effort on identifying the small subset of investment opportunities that align with the mental models about which we are most confident. These high-confidence mental models include our belief that pricing power is derived from goods that reliably confer status and/or cost a small amount relative to both the value they provide and the purchaser’s disposable income. They also include our belief that investors’ overconfidence, avarice, and impatience lead them to generally overprice risky stocks and underprice boring, conservative ones . . . except, of course, in crashes, when their loss aversion trumps all other factors. Finally, they include our belief that investors overestimate their ability to profitably time their entry into and exit out of the market and, for that matter, specific stocks as well. Therefore, despite the rapidly changing world, our core investment strategy is unlikely to change. We continue to 1) focus mainly on high market share, conservatively levered, stable businesses with enduring pricing power and compelling long-term growth opportunities; 2) attempt to acquire these businesses at reasonable valuations when they are experiencing short-term macro-economic and/or operational problems; and 3) stay fully invested in most market environments. Nonetheless, the world is so complex that we wouldn’t be credible if we didn’t adapt and change over time. Recognizing the power of Alphabet’s business model and how it aligns with our high-conviction mental models is one example of this process of change. As the future continues to unfold, we’re quite sure it won’t be the last.

We feel so fortunate to be partners with you all on this investing journey, and we thank you so much for your trust and your support. As always, please feel free to call us with any questions or concerns. We are here to help.

Sincerely,

The YCG Team

Disclaimer: The specific securities identified and discussed should not be considered a recommendation to purchase or sell any particular security nor were they selected based on profitability. Rather, this commentary is presented solely for the purpose of illustrating YCG’s investment approach. These commentaries contain our views and opinions at the time such commentaries were written and are subject to change thereafter. The securities discussed do not necessarily reflect current recommendations nor do they represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. These commentaries may include “forward looking statements” which may or may not be accurate in the long-term. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. S&P stands for Standard & Poors. All S&P data is provided “as is.” In no event, shall S&P, its affiliates or any S&P data provider have any liability of any kind in connection with the S&P data. MSCI stands for Morgan Stanley Capital International. All MSCI data is provided “as is.” In no event, shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data. Past performance is no guarantee of future results.

[1] For information on the performance of our separate account composite strategies, please visit www.ycginvestments.com/performance. For information about your specific account performance, please contact us at (512) 505-2347 or email [email protected].

[2] See https://www.similartech.com/compare/dailymotion-video-vs-YouTube.

[3] See https://www.forbes.com/sites/sirenabergman/2017/02/28/we-spend-a-billion-hours-a-day-on-YouTube-more-than-netflix-and-facebook-video-combined/#1e7e609d5ebd.

[4] See https://emailclientmarketshare.com/.

[5] See https://www.netmarketshare.com/browser-market-share.aspx?qprid=0&qpcustomd=0.

[6] See http://www.cnbc.com/2016/11/03/google-android-hits-market-share-record-with-nearly-9-in-every-10-smartphones-using-it.html.

[7] See https://www.datanyze.com/market-share/maps/.

[8] See http://searchengineland.com/data-google-monthly-search-volume-dwarfs-rivals-mobile-advantage-269120.

[9] http://www.Internetworldstats.com/stats.htm.

[10] http://mobilemarketingmagazine.com/24bn-smartphone-users-in-2017-says-emarketer.

[11] See http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/.

[12] See http://marketingland.com/report-e-commerce-accounted-11-7-total-retail-sales-2016-15-6-2015-207088.

[13] See http://www.cnbc.com/2017/07/25/top-google-analyst-says-youtube-is-worth-75-billion.html and http://www.oakmark.com/Oakmark-files/Media/Documents/VII_FreshPerspective_WCN-TWM_053117.pdf.

[14] This category shows up as “Other Bets” in Alphabet’s SEC filings. Estimated losses at $2.5 billion by annualizing losses for the quarter ended 6/30/2017 and tax-effecting this number using a 19% tax rate.

[15] GAAP stands for “generally accepted accounting principles.” These principles treat stock options as an expense, which we believe correctly accounts for their true economic cost.

[16] Analysis of revenue growth rates assumes 14 billion in revenue from YouTube in 2017 versus 10 billion in 2016 as per http://variety.com/2017/digital/news/youtube-ad-boycott-google-revenue-impact-1202014955/ and http://www.marketwatch.com/story/how-youtube-may-now-be-worth-90-billion-or-more-on-a-standalone-basis-2016-06-08. Additionally, it assumes that revenue growth in the categories “Other Bets” (Alphabet’s venture bets) and “Other Revenues” (Google Play, Google Cloud, and Alphabet’s hardware) continues at the same rate as it has in the first six months of 2017. Finally, it assumes that Alphabet’s total revenue growth rate is 20.3%, in line with 2017 consensus analyst estimates.