During the first quarter, the S&P 500 index posted a 6.07% return, adding three more months and substantial additional gains to what is already one of the longest and most profitable bull markets in history.[1],[2] Since bottoming roughly eight years ago at 666, the S&P 500 has, almost without interruption, climbed to 2,363, a stellar return of 255% that doesn’t even include the roughly 2% per year dividend yield received along the way.[3]

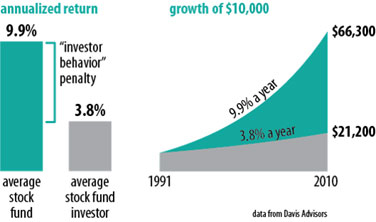

Unfortunately, many investors have not fully participated in this rally because they have attempted to time the market. As can be seen in the graph below, this behavior is woefully misguided.

While the average stock fund over the period from 1991 to 2010 made 9.9% per year, the average stock fund investor made only 3.8% per year. A 6.1% return gap makes a dramatic impact over time as evidenced by the “do-nothing” investor finishing the approximately 20-year period with over three times more money than the average “market-timing” investor.

We believe attempts at market timing prove so damaging for two reasons. First, since the market is unpredictable in the short to medium term, and average yearly expected returns have historically been materially higher than “risk-free” rates available on cash, any time spent out of the market has been likely to result in foregone returns. We believe this logic holds true even when the market appears to be expensive relative to history, as it does today, so long as we can identify investments that we believe will produce attractive rates of return from prevailing prices. Second, humans’ natural tendencies to use our brains as mostly post-hoc rationalizers of our emotions exacerbate the downside of trying to time the market. Since our natural response to declining markets or funds is fear and our natural response to rising ones is greed, our attempts to trade are likely to be ill timed and thus even more value destructive than a pure opportunity cost analysis would suggest.

We believe the “timing fallacy” occurs just as frequently in individual stocks as it does in the market as a whole. Just as many investors recognize that the market is a powerful, high-probability wealth building opportunity, we believe many investors recognize the high probability of making money over time in some of the multinational companies we own. However, these investors, just like the ones in the chart above, believe they can further improve their investment results by timing their entry into and exit from these businesses. We believe these timers are equally misguided, and, thus, once we purchase shares in a business that we believe is both great and available at a reasonable price relative to other investment opportunities, we are apt to hold on to it for long time. Moreover, because investors compound their timing mistakes by fearfully selling temporarily struggling great businesses while rationalizing this behavior as “market timing”, we are always vigilantly searching for situations in which great businesses with long-term tailwinds are experiencing short- to medium-term macro-economic, competitive, and/or operational pressures.

We recently took a position in one such business, Estee Lauder, during a period in which it was grappling with both macro-economic and company-specific operational concerns.

Estee Lauder

We believe Estee Lauder, the second biggest beauty company in the world by revenue, is a great business. It operates in an industry with extremely favorable characteristics, is a clear global leader in this industry, and is controlled by a founding family with a large vested interest in the long-term success of the company. Let’s examine each of these advantages.

First, Estee Lauder operates in an industry with extremely favorable characteristics. Cosmetics such as makeup, skin creams, fragrances, and hair products are disposable and have short repurchase cycles, causing the demand for them to be stable across varied economic environments – so stable, in fact, that global cosmetics revenue even grew during the Recession of 2008.[4] Additionally, the importance of beauty as both a social activity and a sign of status means that, as wealth goes up, spending on beauty is likely to follow. The data supports this thesis with the estimated share of personal care in global consumer expenditures growing from 2.33% in 1996 to 2.41% by the end of 2016.[5] Besides demonstrating the rising importance of personal care to global consumers, this statistic also highlights that personal care expenditures are still quite small relative to total consumer expenditures. Even in a mature market like the U.S., consumers only spend around 6% on personal care.[6] Since cosmetics are only a subset of this already small percentage, many brands should be able to raise prices for many years without pushback since the high value-add of the products combined with their low purchase prices as a percent of disposable income means consumers are unlikely to expend the time and energy to search for substitutes. Additionally, many consumers in emerging countries spend much less than the global average on cosmetics, yielding a large opportunity to increase both pricing and volume over time in these markets. Technological trends further buttress the case for cosmetics growth. The increasing ubiquity of cameras combined with the growth of social apps such as Facebook, Snapchat, and Instagram has turbo-charged photograph taking and sharing, fueling makeup sales. This sales boost is unlikely to abate anytime soon. Anyone with children knows the centrality of the camera in the lives of today’s young people. As young people have children of their own, “camera natives” will become an ever-larger percentage of the population over time, providing a long-term tailwind to makeup revenue. Finally, it’s not lost on us that, even in rich countries, a full 50 percent of the population consume few, if any, cosmetics. Interestingly, this fact may be changing. Millennials report more acceptance of male cosmetics than prior generations,[7] and macho, socially conservative South Korea, where men report using 13 grooming products per month, demonstrates that the probability of widespread adoption may be higher than most investors believe.[8] Regardless, we don’t think we’re paying much for this growth opportunity, giving us a low-cost option with a potentially very large payoff.

Second, Estee Lauder, as the second largest beauty company in the world, holds a very advantaged position in the cosmetics industry. Estee Lauder has sales in 150 countries and territories all over the world with 42% occurring in the Americas, 39% in Europe/Middle East/Africa, and 19% in Asia/Pacific.[9] The company is also diversified by channel with 46% of its sales coming from department stores, 12% from travel retail (airports, etc.), 11% from freestanding retail stores, 8% from specialty and multichannel stores, 6% from its brands’ websites, 5% from perfumeries, and 12% from other outlets, which include salons, spas, military, and pharmacies. Additionally, the company owns more than 25 of the most popular beauty brands including MAC, Clinique, Bobbi Brown, Tom Ford Beauty, and, of course, Estee Lauder. This level of diversification by country, channel, and brand serves to mitigate risk because struggles in some areas of the company are likely to be offset by successes in others. Interestingly, though, Estee Lauder has chosen to be somewhat less diversified in product line relative to its bigger competitor, L’Oreal. Thus far, this decision has proved quite prescient, as Estee Lauder is over-indexed to the beauty categories that stand to benefit most from our increasingly camera-focused culture with over 80% of its revenue in skin care and makeup and less than 20% in fragrance and hair care. Estee Lauder has further focused its resources on higher end items, enabling the company to become the leader in global prestige beauty with 14.5% market share.[10] Even more impressively, it dominates the prestige make-up category with 27.7% share versus L’Oreal, the number two player, at 13.0%. In summary, we believe the combination of Estee Lauder’s marketing and distribution power with its strength in luxury is likely to confer above industry pricing and revenue growth over time. Estee Lauder’s 7% constant currency sales growth over the last five years versus 5% growth for the prestige beauty category and 3.5% for mass and direct beauty seems to support this case.

Lastly, the beauty industry is characterized by high founding family ownership, which we believe is likely to result in rational, long-term oriented growth, investment, and pricing strategies. Estee Lauder is no exception. The Lauder family owns approximately 40 percent of the total common stock and about 87 percent of the voting power, protecting them from the subset of private equity and activist “investors” who prioritize short-term profits over long-term business value. Nowhere is Estee Lauder’s long-term mindset more apparent than on its balance sheet. Unlike many other businesses that have used the low interest rate environment to lever up, Estee Lauder has remained conservative, giving it a financial war chest that it can use to protect its competitive position, invest for growth, and/or cushion results during economic downturns.

As a result of these many favorable characteristics, Estee Lauder has generally been expensive relative to other opportunities in the market (and even relative to other consumer staples). However, a combination of macroeconomic and company-specific operational concerns meaningfully closed this gap at the end of last year.

On the macroeconomic side, investors have built a narrative of optimism over the last nine years about the United States’ medium-term economic prospects relative to the rest of the world. This U.S. optimism has negatively affected Estee Lauder, which generates approximately 70 percent of its revenues internationally, in two main ways. First, it has likely pressured the relative price-to-earnings multiple that investors are willing to pay for the international component of Estee Lauder’s business.[11] Second, the rising optimism about the U.S. has increased the demand for U.S. dollars, causing the value of the dollar to rise relative to other currencies. This dollar strength has reduced the value of Estee Lauder’s international sales and profits to U.S. investors. For instance, if the U.S. dollar strengthened by 10 percent relative to the Euro, then a U.S. investor would receive 10 percent fewer dollars from a constant amount of European sales. To make matters worse, roughly half of Estee Lauder’s costs are U.S. dollar-based compared with only a third of its sales, pressuring international profits to an even greater extent than international sales.

On the operational side, Estee Lauder has also experienced some challenges. At the end of last year, after several years of steady 6 to 7% underlying sales growth, Estee Lauder reported a below-expectation quarter of 2% underlying sales growth. On its earnings call, Estee Lauder explained that the sharp drop-off in sales was due, in large part, to mid-tier malls’ struggles to drive traffic in the face of accelerating ecommerce disruption. Having previously believed that the company was largely immune from these forces, the weak sales figure forced investors to confront the hard truth that Estee Lauder, with 46% of its sales coming from department stores, could experience slower and/or lumpier growth over the medium term as it adjusts to the changing retail environment.

Despite its macroeconomic and operational struggles, we believe few investors would question the long-term outlook of Estee Lauder given its many strong brands, its large international growth opportunity, its conservative capital structure, and its leading market share in prestige beauty, an industry with the classic status characteristics that we believe confer enduring pricing power. Nevertheless, we believe many investors responded to the company’s short- to medium-term struggles by rotating out of Estee Lauder to, in many cases, lower quality businesses that they believed had better short-term dynamics, such as more domestic consumer staples and cyclicals levered to the so-called “Trump trade” (i.e. those that would benefit from success on Republican policy objectives such as increased infrastructure spending, lower tax rates, higher interest rates, and a stronger dollar). Because of our long-term focus, we zigged when these investors zagged and bought shares of Estee Lauder during this period. While we don’t know whether Estee Lauder will go up this week, this month, or even this year, we believe we acquired shares in the company at a price that will allow us to compound our capital at attractive rates for years to come.

Concluding Remarks

The siren song of market timing is incredibly seductive. It promises the big long-term gains of the stock market without the painful interim losses. Unfortunately, as in the Greek myths, heeding the song’s appeal is more likely to lead to sorrow than elation. Instead of succumbing to our false hopes, we must stoically accept that the economy, the stock market, and our companies will experience occasional but unpredictable periods of difficulty. Our acceptance of this fact helps us to remain invested in both good times and bad, to buy great businesses when they’re experiencing transitory problems, and to temper our enthusiasm during ebullient bull markets like today’s. Finally, it’s informed our decision to employ a strategy focused on owning dominant, easy-to-understand, conservatively levered businesses that, while perhaps more boring than other approaches, we believe is highly likely to slowly compound wealth over time, no matter what the future holds.

As always, please feel free to call us with any questions or concerns, and we thank you for your trust.

Sincerely,

The YCG Team

Disclaimer: The specific securities identified and discussed should not be considered a recommendation to purchase or sell any particular security nor were they selected based on profitability. Rather, this commentary is presented solely for the purpose of illustrating YCG’s investment approach. These commentaries contain our views and opinions at the time such commentaries were written and are subject to change thereafter. The securities discussed do not necessarily reflect current recommendations nor do they represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. These commentaries may include “forward looking statements” which may or may not be accurate in the long-term. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. S&P stands for Standard & Poors. All S&P data is provided “as is.” In no event, shall S&P, its affiliates or any S&P data provider have any liability of any kind in connection with the S&P data. MSCI stands for Morgan Stanley Capital International. All MSCI data is provided “as is.” In no event, shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data. Past performance is no guarantee of future results.

[1] For information on the performance of our separate account composite strategies, please visit www.ycginvestments.com/performance. For information about your specific account performance, please contact us at (512) 505-2347 or email [email protected].

[2] http://fortune.com/2017/03/09/stock-market-bull-market-longest/

[3] The S&P 500 reached its intraday bottom on March 6, 2009, and it finished at 2,362.72 as of March 31, 2017.

[4] See https://www.statista.com/statistics/307411/revenue-of-the-global-cosmetics-industry/.

[5] See http://www.loreal-finance.com/_docs/0000000132/CAGNY_2017_2402_.pdf.

[6] See https://www.bls.gov/opub/reports/consumer-expenditures/2015/pdf/home.pdf.

[7] See http://www.adweek.com/brand-marketing/millennial-guys-are-turning-makeup-150313/.

[8] See http://www.smh.com.au/business/world-business/south-korean-men-are-wearing-makeup-and-its-serious-business-20161228-gtivin.html, http://money.cnn.com/2015/10/04/news/south-korea-men-cosmetics/, and http://www.economist.com/news/business/21679459-how-local-cosmetics-brands-are-getting-under-mens-skin-east-rouge.

[9] Data on geographic, channel, and product line splits comes from Estee Lauder’s 2016 10-K.

[10] Data on market share comes from https://www.elcompanies.com/~/media/Files/E/Estee-Lauder/events-and-presentations/barclays-presentation.pdf.

[11] See charts and discussion in our Q4 2016 letter at https://ycginvestments.com/media/35-2016-12-31-Client-Letter—Final-(website).pdf.